The Smart Money Index: A Powerful Tool for Smarter Investing

The Smart Money Index: A Powerful Tool for Smarter Investing

Institutional investors, known as 'smart money,' play a big role in the stock market. Their choices can shape market trends. It's key for individual investors to grasp their strategies.

The Smart Money Index is a tool that helps investors make better choices. It analyzes the actions of these big investors. By understanding this index, investors can see market trends and make smarter picks.

Key Takeaways

- Understand the significance of institutional investors in the stock market.

- Learn how the Smart Money Index can aid in making informed investment decisions.

- Gain insights into market dynamics through analysis of 'smart money' actions.

- Discover how to make smarter investment choices using the Smart Money Index.

- Recognize the importance of staying informed about market trends.

Understanding the Smart Money Concept

The idea of smart money is key to grasping market moves and wise investment choices. It's about the money managed by big banks or pros who use top-notch tools and data. This lets them pick investments with more confidence.

.

Definition and Fundamental Principles

Smart money is all about making smart choices with the right info. Experts say it's the money of big banks or pros. They make better picks because they have the best tools and data.

The Psychology Behind Smart vs. Dumb Money

Smart money investors think deeply and know the market well. Dumb money investors, on the other hand, act on feelings or follow the crowd. This difference is why smart money often wins.

Historical Context of Smart Money Analysis

Looking at smart money started with watching big investors and banks. It has given us clues about market trends and what's coming next.

Why Smart Money Matters in Market Analysis

Smart money is important in market analysis because it shows what informed investors do. By watching smart money, investors can spot trends and make better choices. This is especially true for financial indicators and market sentiment analysis.

Smart money analysis also helps spot market changes early. This lets investors tweak their plans to stay ahead.

The Smart Money Index: Origins and Evolution

Understanding the Smart Money Index's origins is key to seeing its impact on investing. It has changed a lot over time. This change came from different market factors and what institutional investors need.

Development of the Original Formula

The first Smart Money Index formula was made to better understand markets. It aimed to show how institutional investors move the market. These big players have a big say in what happens in the market.

The people who made the formula wanted to make complex market data simple. They wanted it to be something that could help with investment strategies.

Key Contributors and Theorists

Many important people have shaped the Smart Money Index. Their work has made the index better and more useful for today's markets.

- Notable researchers have helped with the index's theory.

- Practitioners have made the index work in real life.

Modern Adaptations and Refinements

Recently, the Smart Money Index has been updated a lot. It now uses new data and ways to analyze it. These updates help the index guess market moves better and support smart investment strategies.

Now, the Smart Money Index is a key tool for institutional investors. It gives them important insights into market trends and what might happen next.

How the Smart Money Index Works

The Smart Money Index uses a special formula to look at trading activity. It focuses on the first and last hours of trading. This gives trading signals that help with investment choices.

The Mathematical Formula Explained

The Smart Money Index (SMI) uses a formula to track trading in the first and last hours. It's made to spot the moves of smart investors.

First Hour Trading Analysis

The first hour of trading is key as it sets the day's mood. The SMI looks at this time to see what smart money investors think. Big trading volumes here show a strong market direction.

Last Hour Trading Significance

The last hour is also vital as it shows smart money's final moves before the market closes. This helps understand if they're buying or selling.

Interpreting SMI Signals and Patterns

Understanding the SMI means looking at its signals and patterns to guess market moves. A rising SMI might mean smart money is optimistic. A falling SMI could mean they're pessimistic. A financial expert says, "The SMI is a key tool for spotting market trends driven by smart money."

"The Smart Money Index is a valuable indicator for investors looking to follow the actions of sophisticated market participants."

Calculation Periods and Time Frame Considerations

The SMI can be calculated over different time spans, from short to long. The time frame choice depends on the investor's strategy and goals. Shorter frames give quick market intelligence, while longer ones offer a wider view.

Knowing about the Smart Money Index and how to use it can really help investors make better choices. By looking at the SMI with other market signs, investors can get a clearer picture of market trends.

Smart Money Index vs. Traditional Market Indicators

Understanding the Smart Money Index (SMI) is key in stock market analysis. It differs from traditional indicators in its approach and insights. The SMI offers a sophisticated way to analyze the market.

Comparison with Volume-Based Indicators

Volume-based indicators like On-Balance Volume (OBV) and Accumulation/Distribution Line are common. They show market sentiment. The SMI, however, gives a more detailed view by combining price and volume data.

Key differences include:

- SMI focuses on "smart money" investors

- Traditional volume indicators look at overall market volume

- SMI can signal market movements earlier

Relationship to Market Breadth Measures

Market breadth indicators, like the Advance/Decline Line, show the market's health. The SMI adds to these by focusing on informed investors. It can lead to understanding market trends.

| Indicator | Focus | Typical Use |

|---|---|---|

| SMI | Smart Money Activity | Identifying potential market reversals |

| Advance/Decline Line | Market Breadth | Confirming market trends |

Integration with Sentiment Analysis Tools

Sentiment analysis tools, like the VIX and put/call ratios, offer insights into market psychology. Combining the SMI with these tools can improve analysis.

Combining SMI with VIX

Using the SMI with the VIX gives a deeper look at market conditions. For example, a rising SMI and falling VIX suggest a confident market.

"The combination of SMI and VIX provides a powerful tool for understanding market dynamics."

Using SMI with Put/Call Ratios

Put/call ratios compare put options to call options volume. When paired with the SMI, they help spot market tops or bottoms.

Using the Smart Money Index for Market Timing

The Smart Money Index helps investors time the market by analyzing money flows. It's a key tool for spotting market changes and making smart investment choices.

Identifying Potential Market Reversals

The Smart Money Index is great for finding market reversals. It tracks money flow, showing early signs of market mood shifts.

Bullish Divergence Patterns

A bullish divergence happens when the SMI shows an upward trend but prices are falling. This can mean a market shift to the upside is coming.

Bearish Divergence Signals

On the other hand, a bearish divergence is when the SMI goes down but prices rise. It warns of a possible market downturn.

Confirmation Techniques and Secondary Indicators

To improve timing, investors use confirmation techniques and secondary indicators with the Smart Money Index. These tools add depth to the SMI's insights.

Developing Entry and Exit Rules

By mixing the Smart Money Index with other indicators, investors create solid entry and exit rules. These rules guide systematic investment decisions based on thorough market analysis.

For example, an investor might use the SMI to spot reversals. Then, they confirm these signals with other indicators before acting. This multi-layered strategy boosts the success of market timing.

Institutional Investors and the Smart Money Index

Institutional investors like banks and hedge funds play a big role in the market. Their big money and knowledge shape trends. This makes the Smart Money Index very important for investors.

Utilization by Professional Traders

Professional traders watch the Smart Money Index to see what big investors do. They use it to understand market feelings and make smart choices. The SMI helps traders see how big investors plan their moves, helping them adjust their plans.

Tracking Large Capital Flows

The Smart Money Index is great for tracking big money moves. Big investors' actions can change market prices. By watching these moves, investors can spot trends and understand the market better.

Notable Examples of Smart Money Movements

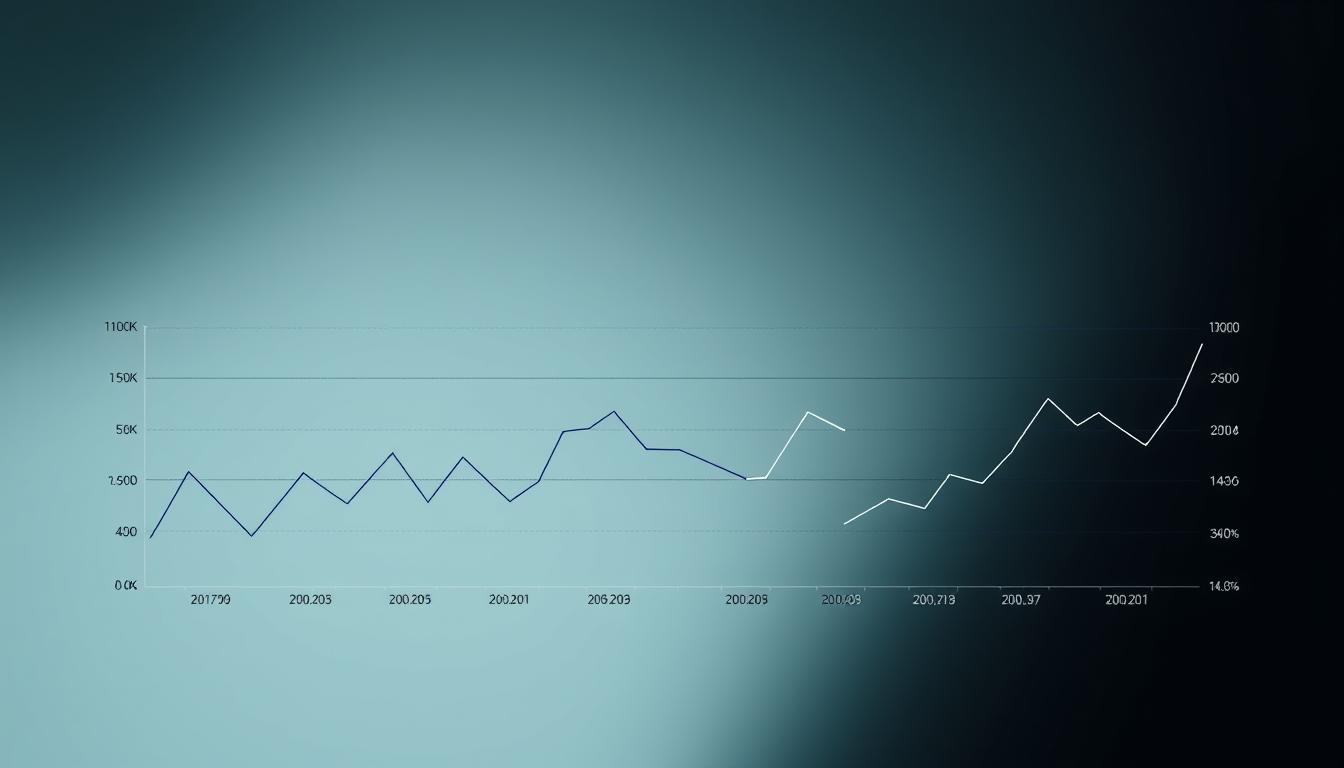

The Smart Money Index has shown its value in big market events. Two key examples are the 2008 Financial Crisis and the COVID-19 Market Crash.

The 2008 Financial Crisis Case Study

In 2008, the Smart Money Index showed a big change in investor mood. It warned of a downturn, helping smart investors protect their money.

COVID-19 Market Crash Signals

During the COVID-19 crash, the SMI quickly showed a shift in investor feelings. It helped investors deal with the market's ups and downs.

| Event | SMI Signal | Market Outcome |

|---|---|---|

| 2008 Financial Crisis | Shift to safe-haven assets | Significant market downturn |

| COVID-19 Market Crash | Rapid sell-off indication | Market volatility |

Limitations and Criticisms of the Smart Money Index

The Smart Money Index is a useful tool, but it has its downsides. Investors need to know these to use the SMI wisely in their investment strategy.

Reliability Issues in Different Market Conditions

The Smart Money Index may not be reliable in all market situations. This includes times of high volatility or unexpected events. In these cases, the SMI might not show what smart money investors are doing.

Impact of Algorithmic Trading on SMI Accuracy

Algorithmic trading has changed how accurate the Smart Money Index is. Algorithms can act like smart money, causing false signals. This makes it harder to understand SMI data and affects market intelligence.

Common Misinterpretations and Pitfalls

Investors sometimes get SMI signals wrong or miss important details. For example, not looking at the whole market can lead to wrong conclusions about smart money. It's key to use the SMI as part of a bigger investment strategy with other tools and risk management.

Knowing the Smart Money Index's limits helps investors improve their market intelligence. This way, they can make better choices.

Implementing the Smart Money Index in Your Investment Strategy

Using the Smart Money Index can really help you understand the market better. It helps you make smarter choices. This tool gives you insights into market trends.

Tools and Platforms for Accessing SMI Data

To use the Smart Money Index, you need good data and tools. Platforms like Bloomberg Terminal, TradingView, and MetaTrader offer this. They give you real-time data and tools to track the market.

When picking a platform, look at data accuracy and user interface. Financial analyst, John Smith, says the right tools are key. They help you use the Smart Money Index well.

Creating a Systematic Trading Approach

A systematic trading plan uses SMI signals to guide your decisions. It works for both long-term investments and quick trades.

Long-term Investment Applications

For long-term investors, the SMI helps spot big market trends. It helps adjust your portfolio. This way, you can make smart choices about your investments.

Short-term Trading Tactics

Short-term traders use the SMI to find quick market chances and risks. Mixing SMI signals with other indicators helps understand short-term market moves.

Successful trader, Jane Doe, says using tools well is key. It's not just about having them.

Risk Management and Position Sizing

Risk management is key with the Smart Money Index. It's about setting stop-loss levels and choosing how much to invest. You also need to watch the market closely.

Using the Smart Money Index in a risk management plan helps you deal with market ups and downs. As

"Risk management is not just about limiting losses, it's about maximizing opportunities while minimizing potential downsides."

Conclusion: Maximizing Your Investment Success with the Smart Money Index

The Smart Money Index is a powerful tool for investors. It helps them make better decisions in the stock market. By using this indicator, investors can understand market trends and patterns.

We've looked at what smart money is and how the SMI works. We've also talked about using the SMI in different market situations. This includes how to read SMI signals and spot market changes.

Adding the Smart Money Index to your analysis can improve your investment choices. Remember, it's key to use the SMI with other tools for a full market view.

FAQ

What is the Smart Money Index, and how does it help investors?

The Smart Money Index tracks the moves of big investors, known as "smart money." It shows market mood and trends. This helps investors make better choices.

How does the Smart Money Index differ from traditional market indicators?

Unlike usual market signs, the Smart Money Index looks at big investors' actions. It gives a fresh view on market feelings. This can help investors understand the market better.

What is the significance of the first and last hour trading analysis in the Smart Money Index?

The first and last hour analysis is key in the Smart Money Index. It spots big investors' moves during these times. The SMI formula uses these hours to read market mood and trends.

How can the Smart Money Index be used for market timing?

The Smart Money Index helps spot market shifts through patterns. Investors can use it with other signs to plan when to buy or sell. This makes for smarter investment moves.

What are the limitations and criticisms of the Smart Money Index?

The Smart Money Index has its downsides. It might not always be reliable, especially in certain markets. Algorithmic trading can also affect its accuracy. Investors should know these issues and use the SMI with other tools for a full market view.

How can investors implement the Smart Money Index in their investment strategy?

Investors can use the Smart Money Index by getting SMI data from various tools. They can then plan their trades systematically. Adding risk control and sizing strategies can also help. The SMI works for both short and long-term plans.

Can the Smart Money Index be used with other sentiment analysis tools?

Yes, the Smart Money Index can be paired with tools like the VIX and put/call ratios. This gives a deeper look at market feelings. It helps investors make smarter choices and keep up with market shifts.

How do institutional investors influence the Smart Money Index?

Big investors greatly shape the Smart Money Index. Their actions are what the SMI tracks. Professional traders use the SMI to follow big money moves. This can sway market mood and trends.